Caustic prices correct by nearly 30 % in China from peak levels. New offers emerge dramatically lower. Deals into S E Asia being negotiated nearly 30 % lower than highs reported in last few weeks.

Below is an analysis of major drivers going forward.

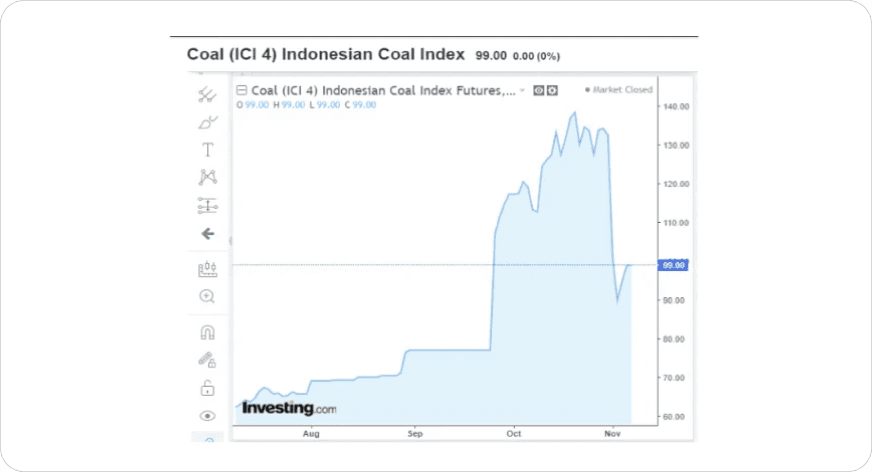

Coal and Energy

Indonesian Coal prices more than halved. GC Newcastle coal futures also fell in tandem. Chinese coal production rose to 11.6 Million MT per day. Coal stocks at power plants now exceed 2 weeks consumption up from 2 days. Huge surge in imports from Russia and Indonesia supplemented stocks. Currently only 2 provinces in China face significant power shortages.

This relieves cost pressure on chlor alkali chain and higher availability of power increases production.

Chlorine

Chlorine netbacks still robust and phenomenally high despite marginal drop in PVC prices. All Chlorine derivatives still doing well. Chlor Alkali operating rates will remain high and availability of Caustic will remain high.

Caustic Supply Chain

Despite delays in Chinese ports for loading all commodities including Caustic Soda Liquid, ships are indeed moving after delays for 1 to 2 weeks. They are reaching end customers. In addition to these supplies the panic buying at higher and higher prices from other origins have reached or are reaching the end customers. This means that any offer at abnormal levels is getting rejected. Some shortfalls could still be evening out, but largely end customers are well covered well into Q1 2022.

Production

There are no production issues at Chlor Alkali plants in all major geographies. This is a comforting situation after a year of major disruptions.